The frequent complaint made about rental properties is that they cost so much to maintain. However, anything used will need maintenance. The high side is that the IRS is aware of this also. This is the hidden benefit of rental depreciation. Did you ever think you could appreciate the IRS? You can now.

You can depreciate the value of the buildings on your rental properties. Land doesn’t wear out so there isn’t any depreciation there.

You can depreciate a property if:

- You own the property in question.

- The property is used for a business or produces income.

- It will have an end life you can determine.

- The property will last longer than a year.

When can I depreciate my rental property?

You can start depreciating your rental on the day it’s ready to move in to. The end of the depreciation period comes when you’ve deducted your entire cost or other basis. The depreciation period also ends if the rental is no longer used to produce income. However, it’s o.k. to continue depreciation between tenants.

How do I calculate depreciation?

Let a trained professional calculate your depreciation. This isn’t something you want to make a mistake on or misunderstand. This could be very detrimental to your ROI. However, you should have a general idea of how it works. Ignorance is not bliss where it comes to taxes.

Depreciation is based on three things.

- The basis or cost of the property.

- The recovery period.

- The depreciation method used.

The basis or cost of the entire property.

What you paid for the property is its basis. It doesn’t matter if you paid for it with cash, a loan or a combination of the two. There are always other things involved. You can include things like: settlement fees, closing costs such as legal fees, recording fees, surveys, transfer taxes, title insurance, and back taxes in the basis.

Separate the cost of the land and the buildings on it.

The buildings can be depreciated, the land cannot. Again, the land doesn’t lose value. Next, determine what the current tax assessment value is for the entire property. Then determine what percentage of the value is buildings’ value, and what percentage is the value of the land. For example, your rental is currently worth $150,000. The buildings are worth $120,000 and the land is worth $30,000. The buildings are worth 80% of the value property. Therefore, the land is worth 20% of the value of the property.

Determine your basis in the buildings on the property

- Use the 80% building value in the previous example. Say your original basis is $100,000. Multiply .8 times the original purchase price of $100,000. The result, $80,000, is your basis in the buildings on the property.

Adjust your basis if necessary

- Improvements to the property that last more than a year, completed before the property was rented will increase your basis.

- Insurance payments to repair the property will decrease your basis.

- There are a number of items that can increase and decrease your basis. The IRS covers this in Publication 946.

- Again, a professional is best qualified to determine what will, and what won’t, change your basis in a property.

If your property was rented after 1986, it will be depreciated using one of two systems within MARCS. MARCS stands for Modified Accelerated Cost Recovery System.

Within MARCS there are two systems. The first is the General Depreciation system or GDS. The second system is the Alternative Depreciation System. GDS is used in nearly every case. ADS is used when the law requires it or you elect to. The choice to use ADS is irrevocable. A tax accountant is best qualified to choose the system you use to depreciate your property. There are benefits to each. If you use GDS, your property will be depreciated over 27.5 years. If you choose to use ADS, the depreciation periods are different. Properties placed in service after December 31st 2017 are depreciated over 30 years. Properties rented out before that, are depreciated over 40 years.

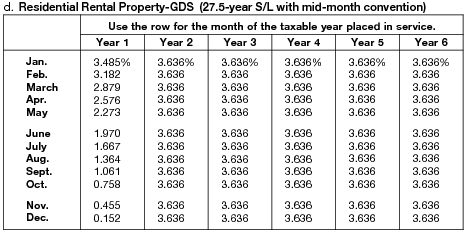

You can depreciate 3.636% every year for 27.5 years using the GDS system. However, you won’t get a full 3.636% for the first year of depreciation. Starting in January you lose a percentage of the deduction based on this IRS table:

The End Game

Depreciation will reduce your tax liability. The reduction depends on your tax bracket and the amount that you deduct. Again, consult a tax professional. This is a complex process and important to your ROI. Your ROI isn’t something you want to relegate to the DIY level.

Reducing your tax liability over a long term is attractive. However, there is a penalty at the end. If you depreciate the value of a property and sell it for more than that depreciated value. you will be subject to depreciation recapture tax. Consult a tax accountant.

To learn more about how Jacob Grant can improve your Passive ROI with preventative inspections call 208-795-8218 or schedule a call Schedule call