Idaho Falls Property Management Done the Jacob Grant Way for YOUR Investment Journey

Are you about to buy your first investment home? Or, perhaps you’re looking to expand your portfolio with another development property?

Read More »

Learn More About Our Services

What makes Jacob Grant different?

Traditional landlords and property management companies who have their mindset want to save money by spending as little as possible and DIYing everything. This disregards the feelings of tenants and only targets short-term benefits.

Jacob Grant wants to grow your income until you reach financial independence by treating your investments like a business. This means that we spend strategically on proactive maintenance done by experts. We also ensure that you and your renters get the best in customer service. Finally, we utilize continuous improvements to target long-term growth in both cash flow and the value of your properties.

Talk to Jacob Grant today to find out how we can apply our business strategies to your Idaho Falls investment properties.

Jacob Grant: Idaho Falls Property Management Like No Other

A traditional landlord mindset can only get you so far. If you want financial independence through real estate investment, then partner up with Jacob Grant. We’ll grow your real estate portfolio, regular cash flow, and long-term returns by treating your investments like a business.

What Can We Do For You?

Jacob Grant delivers proven results in Idaho Falls Property Management through business strategies.

Property Management

We use business strategies to market, manage, and maintain your investments.

Real Estate Investing

We can increase your long-term cash flow by guiding you in buying or building new investments.

Our Success Speaks for Itself

At Jacob Grant Property Management, we pride ourselves on having the best maintained and cleanest rental properties in Idaho Falls.

We’ve also delivered proven results, such as…

We increased an 82-unit community’s property value by $280K and increased our client’s income by 8.9%

We got a 15% increase in property value and income just by recommending and applying strategic capital improvements to a fourplex.

An investor got an 8% return on his money without doing any daily management because of our turnkey approach to his passive income goals.

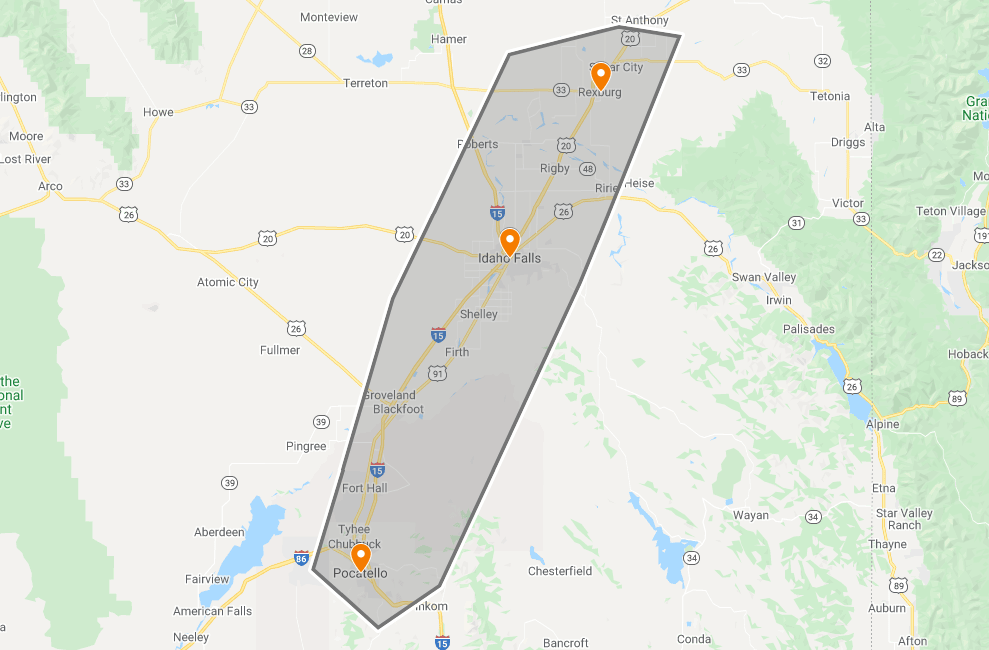

Areas We Serve